Today we will take a look at Python stock analysis with Pandas. I hope that this tutorial is the first of many on quantitative trading and stock analysis with Python. If you are looking for a simple way to get started analyzing stock data with Python then this tutorial is for you.

In today’s post we will take a look at the following topics:

- Downloading stock data with Pandas Data Reader library

- Using Python Pandas library for stock analysis

- Performing technical analysis with Python

- Graphing stock data with matplotlib and Python

Before we begin analyzing stock data we need a simple reliable way to load stock data into Python ideally without paying a hefty fee for a data feed. Using Python Pandas for stock analysis will get you up and running quickly. All of your data can be easily manipulated and sliced however you see fit, without needing to write a bunch of code first. Why reinvent the wheel?

Using pandas_datareader, you can easily connect to a variety of data sources. The available readers offer simple stock data, as well as earnings report data, FED reports and much more. Take a look at the documentation to see all the sources that are offered.

I have taken the time to inspect the results of various data sources (I’ll be sure to write up a guide someday) and found that AlphaVantage meets my criteria; free for personal use and provides up to date data. AlphaVantage is easily one of the best stock data sources I have found so far. Sign up is free and I have not run into any limits with my daily usage.

Loading stock data in Python

Fire up your favorite editor and let’s write some code to pull in stock data from AlphaVantage (or whichever provider you’ve selected).

If you are using AlphaVantage you’ll need to sign up to receive your free API key. So make sure you have that handy, and let’s get started.

We will utilize pandas_datareader (Github) library to get the latest open, high, low, close, and volume values from AlphaVantage. Make sure you are in your virtual environment and install the requirements. If you’ve downloaded the source code you can just run:

pip install -r requirements.txtOtherwise install the required packages manually:

- matplotlib

- pandas

- pandas-datareader

- ta

Now let’s create a DataReader and load the data. Make sure to replace the API_KEY with your actual API key.

import pandas_datareader.data as pdr

API_KEY = 'XXXXXXXXXXXXX'

DATE_START = '2019-01-01'

DATE_END = '2019-10-11'

SYMBOL = 'AAPL'

# We use the 'av-daily' DataReader to download data from AlphaVantage

stock = pdr.DataReader(SYMBOL, 'av-daily',

start=DATE_START,

end=DATE_END,

api_key=API_KEY)

print(stock)Running the above code will print the output shown below. You’ll note that calling ‘print’ on a large DataFrame automatically truncates the response.

open high low close volume

2019-01-02 154.8900 158.85 154.2300 157.92 37039700

2019-01-03 143.9892 145.72 142.0000 142.19 91312200

2019-01-04 144.5300 148.55 143.8000 148.26 58607100

2019-01-07 148.7000 148.83 145.9000 147.93 54777800

2019-01-08 149.5600 151.82 148.5200 150.75 41025300

... ... ... ... ... ...

2019-10-07 226.2700 229.93 225.8400 227.06 30576500

2019-10-08 225.8200 228.06 224.3300 224.40 27955000

2019-10-09 227.0300 227.79 225.6400 227.03 18692600

2019-10-10 227.9300 230.44 227.3000 230.09 28253400

2019-10-11 232.9500 237.64 232.3075 236.21 39216958

[197 rows x 5 columns]

Now that we have the stock data in a DataFrame we can select individual columns:

>>> stock['close']

2019-01-02 157.92

2019-01-03 142.19

2019-01-04 148.26

2019-01-07 147.93

2019-01-08 150.75

...

2019-10-07 227.06

2019-10-08 224.40

2019-10-09 227.03

2019-10-10 230.09

2019-10-11 236.21

Name: close, Length: 197, dtype: float64Or even select specific rows:

>>> stock.loc[stock['close'] >= 220]

open high low close volume rsi

2019-09-11 218.07 223.71 217.73 223.59 44289600 78.879914

2019-09-12 224.80 226.42 222.86 223.09 32226700 76.952359

2019-09-17 219.96 220.82 219.12 220.70 18318700 65.554725

2019-09-18 221.06 222.85 219.44 222.77 25340000 69.516856

2019-09-19 222.01 223.76 220.37 220.96 22060600 62.288148

2019-09-25 218.55 221.50 217.14 221.03 21903400 60.353314

2019-09-30 220.90 224.58 220.79 223.97 25977400 65.732356

2019-10-01 225.07 228.22 224.20 224.59 34805800 67.045981

2019-10-03 218.43 220.96 215.13 220.82 28606500 52.970745

2019-10-04 225.64 227.49 223.89 227.01 34619700 65.875110

2019-10-07 226.27 229.93 225.84 227.06 30576500 65.962158

2019-10-08 225.82 228.06 224.33 224.40 27955000 57.031901

2019-10-09 227.03 227.79 225.64 227.03 18692600 62.780496

2019-10-10 227.93 230.44 227.30 230.09 28253400 68.447604

2019-10-11 232.95 237.64 232.31 236.21 41698900 76.651607Before we can make any useful decisions from our data we need to apply some analysis to it first. This is covered in the next section.

Analyzing stocks with Python

Now that we have our data, let us do something useful with it. I will demonstrate how to compute the RSI of our stock with Python. To do this we use the fantastic technical analysis library so lets include that with our other imports:

import taNow after gathering the data with pdr.DataReader() we can calculate the RSI.

stock['rsi'] = ta.momentum.rsi(stock['close'])

print(stock)Here the rsi() function is computing the RSI using the stock’s ‘close’ price column and storing the results in a new column of the DataFrame. You can also adjust the period by providing an additional parameter. Here we compute the 10 period RSI instead of the default 14:

stock['rsi'] = ta.momentum.rsi(stock['close'], n=10)Now that we have a handle on manipulating and analyzing data with Python, let’s see what this data looks like visually.

Displaying data with matplotlib

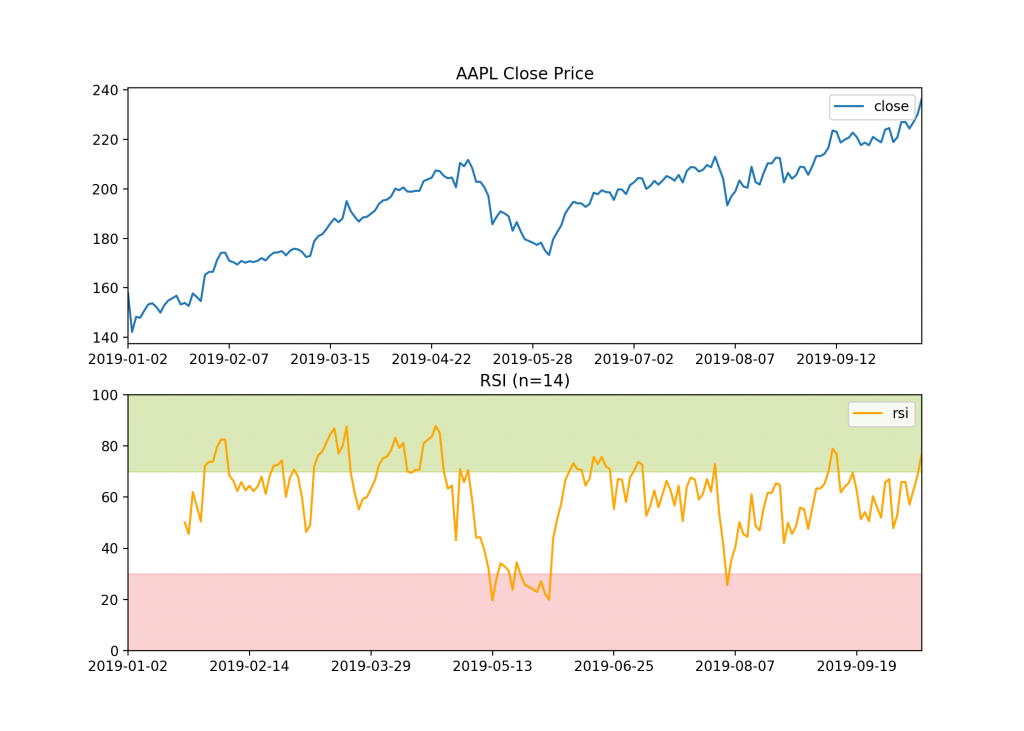

Looking at data on the terminal is no fun. We need a way to quickly visualize data so we can get a feel for the unique characteristics of our data. Since our ‘stock’ DataFrame now includes an additional column with the RSI values we can quickly graph the values with a few calls to plot().

First we’ll import the necessary code at the top of our file:

import matplotlib.pyplot as plt

import matplotlib.gridspec as gridspecThen after computing the RSI we can create a window and show our plots. Since the RSI and our stock price use different axes we will use subplots to display both values on separate plots. We also add a bit of styling and fill the overbought and oversold regions of the RSI plot.

# set up plots and axes for plotting

fig = plt.figure()

gs = gridspec.GridSpec(2, 1)

ax1 = plt.subplot(gs[0, 0])

ax2 = plt.subplot(gs[1, 0])

# fill overbought and oversold regions on RSI plot

ax2.set_ylim([0, 100])

ax2.fill_between(stock.index, 70, 100, color='#a6c64c66')

ax2.fill_between(stock.index, 0, 30, color='#f58f9266')

# display xaxis labels nicely

ax2.set_xticks(stock.index[::30])

fig.add_subplot(ax1)

fig.add_subplot(ax2)

# plot our stock values

stock[['close']].plot(ax=ax1, title=f'{SYMBOL} Close Price')

stock[['rsi']].plot(ax=ax2, color='orange', title='RSI (n=14)')

# show the window

plt.show()You’ll notice that we select each column before calling plot. Feel free to add values to this list to plot additional lines on the same plot. There we have it, with just a few lines of code we have a beautiful plot of stock price in matplotlib:

I highly recommend you take a look at the documentation for matplotlib as there are numerous options for displaying your plots.

Summary

In today’s blog post you have learned how to do simple stock analysis with Python. We’ve covered a variety of core stock analysis topics including:

- Downloading stock data with Pandas Data Reader library

- Performing technical analysis with Python

- Graphing stock data with matplotlib and Python

With an understanding of these core fundamentals you can begin developing your own quantitative trading strategies and systems.

Keep an eye out for my upcoming posts on stock analysis with Python. If you have any questions using the code discussed in this article, please don’t hesitate to reach out in the comments!